If you’re already using another program and it’s working for you, I won’t discuss you into altering. The Pro version has true double entry accounting, the place you’ll have the ability to track property and liabilities as well as expenses and earnings. For instance, if you took out an EIDL mortgage, you’ll find a way to monitor the stability of the loan.

Plus, Hurdlr also can connect to just about each main U.S. and Canadian bank to further monitor your earnings. I’m not being compensated financially for this publish, although I will embrace a Hurdlr affiliate link which might benefit me financially. There’s a chance to explore Hurdlr free of charge before you should purchase it, which is a great way to take a glance at its charms. If you want what you see there’s a Premium version of Hurdlr, which you can upgrade to at any time from the free model https://www.quickbooks-payroll.org/. Alongside a free edition, the opposite paid-for options in the Hurdlr portfolio make it an affordable answer for all types of employees. Rivals to Hurdlr include QuickBooks, Rydoo, Expensify, Pocketguard and Zoho Expense.

Of the two, ExpensePoint presents more expense-focused tools, corresponding to multilevel approval workflows and spending analytics. While it’s utilized by lots of people there’s now an Enterprise edition of the app, which is aimed toward corporations who have to hold monitor of worker expenses. With its automated workflow tools and real-time standing updates Hurdlr allows all kinds of individuals to keep on prime of their bills. Despite the onset of coronavirus there’s the power to track every overhead, such as mileage prices and then additionally hyperlink transactions to monetary accounts.

At the top of the 12 months, you’ll have the ability to file your state and federal taxes with TaxSlayer via the Hurdlr app. The app may also help you estimate your quarterly taxes and know when to pay them. At no additional cost to you, some or the entire merchandise featured under are from partners who might compensate us in your click.

Gusto Evaluation 2025: Tips On How To Use + Pros And Cons By A Cpa Who Uses It

Let’s talk about every little thing you have to learn about Hurdlr, including the means it works, what services it provides, and how it competes with other companies. Uncovering the highest online earnings strategies is what we’re all about at WebMonkey. And our team has over a decade of experience in building, scaling, and writing about online companies. We hope that our trustworthy and transparent guides help you make money on-line too. Tom also based the blog This Online World – a finance web site dedicated to serving to folks earn cash online – in 2018.

Any time you replenish on gas throughout enterprise journeys or incur some business associated expense, Hurdlr can hold monitor of all of the numbers for you. If you pay for a enterprise expense in cash you can even log that information into the app manually. Hurdlr has a free model that features unlimited mileage tracking and fundamental expense administration.

Hurdlr Evaluation – Income & Expense Tracking App For Rideshare Drivers

He focuses on the practical aspects of software program methods whereas preserving abreast of the industry’s cutting-edge ideas to create informative and engaging content material. When he’s not writing, Samson spends time playing or watching soccer. Nevertheless, know that if you try Hurdlr, you might not be capable of get every thing it advertises with a premium subscription. Hurdlr’s Premium plan is slightly cheaper than Fyle’s Business plan, and there is no free version. Subscribing firms can concern lots of of access keys to their contractors, customers, or members. Like along with your mileage, Hurdlr will hold observe of your occupation purchases for equipment, maintenance, journey, and more.

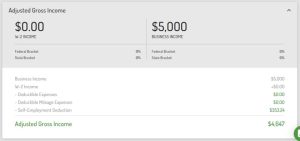

The pro version is $120 per yr, with no month-to-month subscription choice. One of the biggest challenges that self employed particular person or sole proprietor faces is understanding how much cash to save for taxes. When you have ‘other expenses,’ the IRS requires you to break down these other bills, with descriptions, on your Schedule C. Quickbooks and Stride Tax, for instance, don’t allow you to do this. That forces you to spend more time including up and inserting those ‘other’ bills. The widget removes the additional steps of having to log into the app to start or stop your trips.

- This is a great choice to have should you happen to fall a bit behind and wish to get your whole business bills filed away quickly.

- Ashleigh from Customer Service helped me repair the problem and now HurdlrMileageExpensesTax is ideal for my business!

- Of Us, I’m not always working so seriously cut this characteristic out or make it so I can flip it off separate from different pop-ups.

- Moreover, Hurdlr’s API can even hook up with payment platforms like PayPal, Sqaure, Freshbooks, and Uber to observe any facet hustle revenue you are making.

Instead of going again to previous previously reviewed expenses seeking the errors. Hurdlr has exceeded my expectations, and I am certain this normal will continue. I even have been using HurdlrMileageExpensesTax for somewhat over a month now. It has been an excellent help estimating my taxes for the 12 months, monitoring expenses, and tracking miles. I really have two problems hurdlr review that stop me from giving HurdlrMileageExpensesTax a 5-star rating.

Begin your small business off proper and obtain the Hurdlr app now. If you think the Enterprise version is best for you, extra info may be found by providing your contact info to Hurdlr as properly as pricing. If you are on the lookout for somewhat extra robustness from the Hurdlr app, you will have to choose the Premium plan.