It’s essential to maintain correct data of the asset’s depreciation and salvage worth to make sure you’re profiting from the proper tax deductions. Accrued depreciation is the total quantity of depreciation taken during the asset’s class life. You must subtract this from the premise price to keep away from “double-dipping” on tax deductions, as per the IRS. Accrued depreciation is one other key factor, which is the whole depreciation expense taken in the course of the asset’s class life. To calculate salvage worth, you have to know the original buy value of the asset, including any preliminary taxes, shipping charges, or installation costs. A salvage worth of zero is reasonable since it’s assumed that the asset will now not be helpful on the point when the depreciation expense ends.

What Factors Affect The Salvage Value Of An Asset?

The depreciable amount is like the whole loss of worth after all the loss has been recorded. The carrying value is what the merchandise is worth on the books as it’s dropping worth. Companies determine the estimated after tax salvage value for something useful they plan to put in writing off as losing value (depreciation) over time. Each company has its means of guessing how a lot something might be value in the lengthy run. Some firms may say an merchandise is worth nothing (zero dollars) after it’s all worn out as a result of they don’t suppose they’ll get much. But usually, salvage value is important as a end result of it’s the worth a company places on the books for that thing after it’s fully depreciated.

The Method To Calculate Salvage Value For Correct Monetary Planning

- By contemplating these components, you will make knowledgeable decisions about your capital belongings and their financial impact.

- The balance sheet exhibits the net e-book value of an asset, which is the original cost minus accumulated depreciation, helping stakeholders understand the asset’s present value.

- If the corporate has to pay 35% taxes on the achieve, they really acquired $9,750 from the sale.

Depreciation, then again, is the systematic allocation of the cost of an asset over its useful life. It is a technique of recognizing the decline in value and the put on and tear and tear of an asset over time. Depreciation expense is reported on the income statement and reduces the worth of the asset on the steadiness sheet. Imagine you might be an worker of a mid-sized firm tasked with evaluating the financial viability of a major gear upgrade. The current equipment, after years of service, is approaching the end of its helpful life. You’re faced with the choice of whether to promote it or hold it until it turns into out of date.

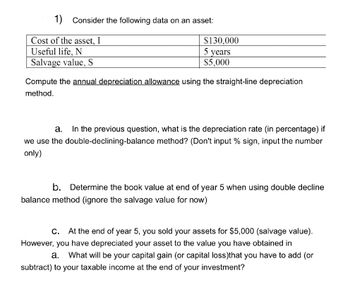

Using The Double-declining Steadiness Depreciation

Let’s contemplate an instance of a producing firm that owns a piece of equipment. After analyzing historical knowledge, market analysis, and assessing the asset’s situation, they estimate the salvage value of the machinery to be $10,000. This estimation takes under consideration components such as technological advancements, market demand, and the asset’s current state. The straight-line methodology is appropriate for property that are anticipated to offer equal benefit over their useful life, similar to buildings or automobiles. The items of manufacturing method is acceptable for property that are primarily used based on its output or manufacturing levels, corresponding to equipment. The declining balance method is best suited to assets which might be https://www.kelleysbookkeeping.com/ expected to be extra productive in their early years and fewer productive as time goes on.

Subsequently, Company A would depreciate the machine at the quantity of $16,000 annually for five years. The fraud was perpetrated in an attempt to satisfy predetermined earnings targets. In 1998, the corporate restated its earnings by $1.7 billion – the most important restatement in historical past. ### The Significance of Customer Income Buyer income is the lifeblood of any enterprise. In the realm of studying and skill acquisition, user-generated tutorials have emerged as a… Running A Blog has emerged as a powerful tool for businesses to draw and interact their inbound gross sales…

Even if the corporate receives a small amount, it might be offset by prices of eradicating and disposing of the asset. Salvage worth is defined as the guide value of the asset as soon as the depreciation has been fully expensed. It is the value a company expects in return for selling or sharing the asset at the how to find salvage value of an asset finish of its life.